- Government Employees: A Silent Change Is Coming That Could Wipe Out Thousands from Your Pension Payout

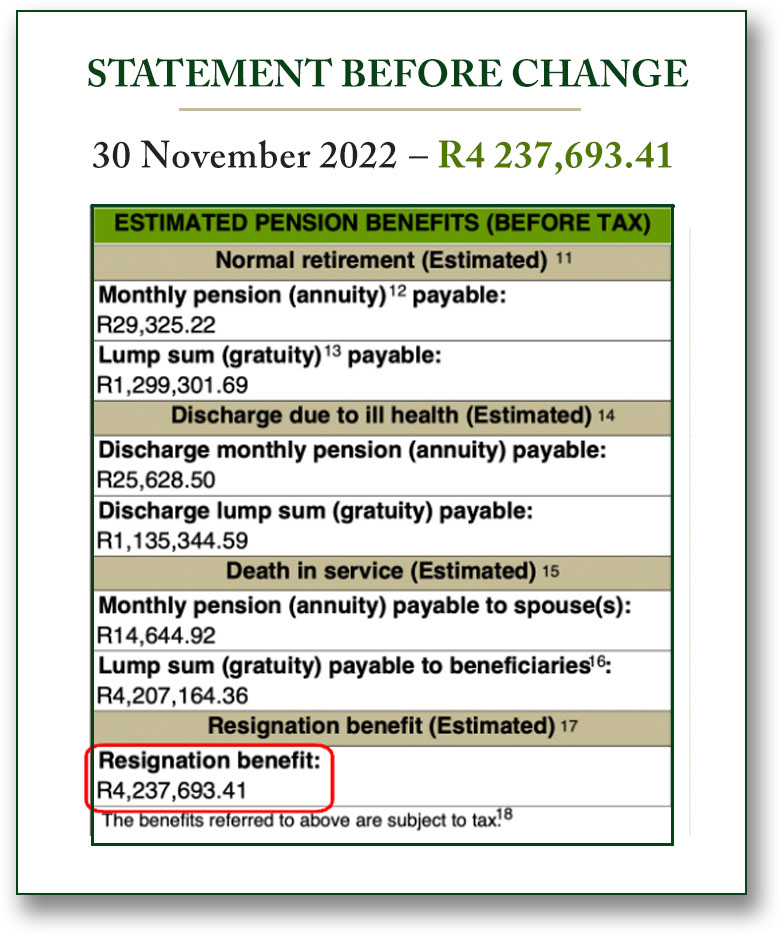

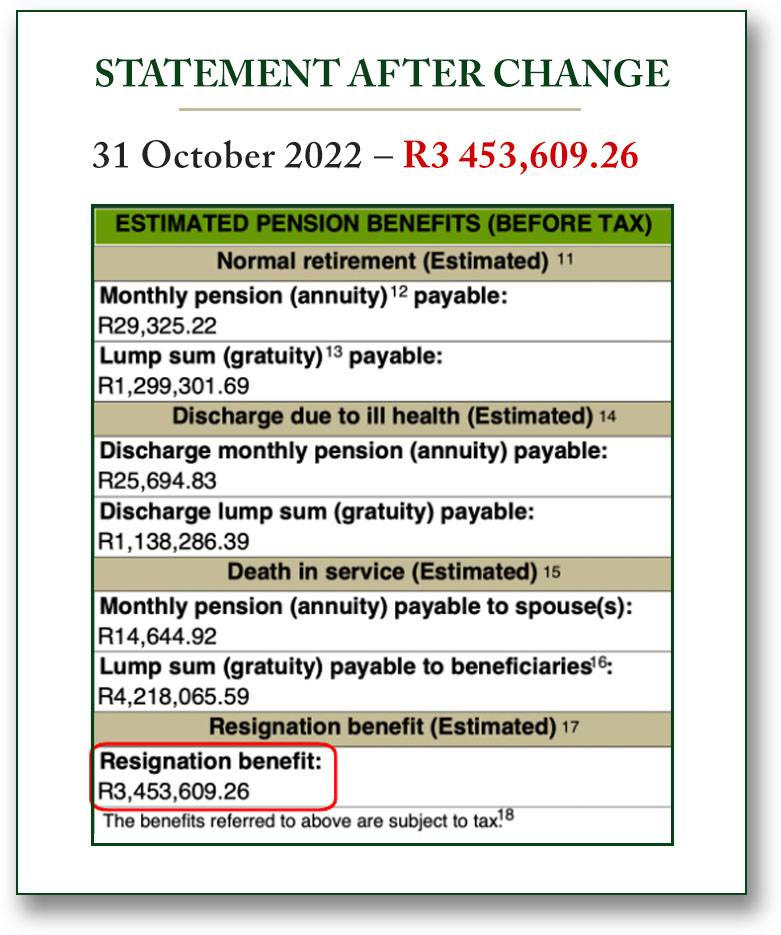

Basil Lost R784,084.15 When the Pension Formula Changed in November 2022.

The Next Change Could Hit as Early as 1 September 2025.

How Much Will You Lose?

Basil (Former SAPS Captain)

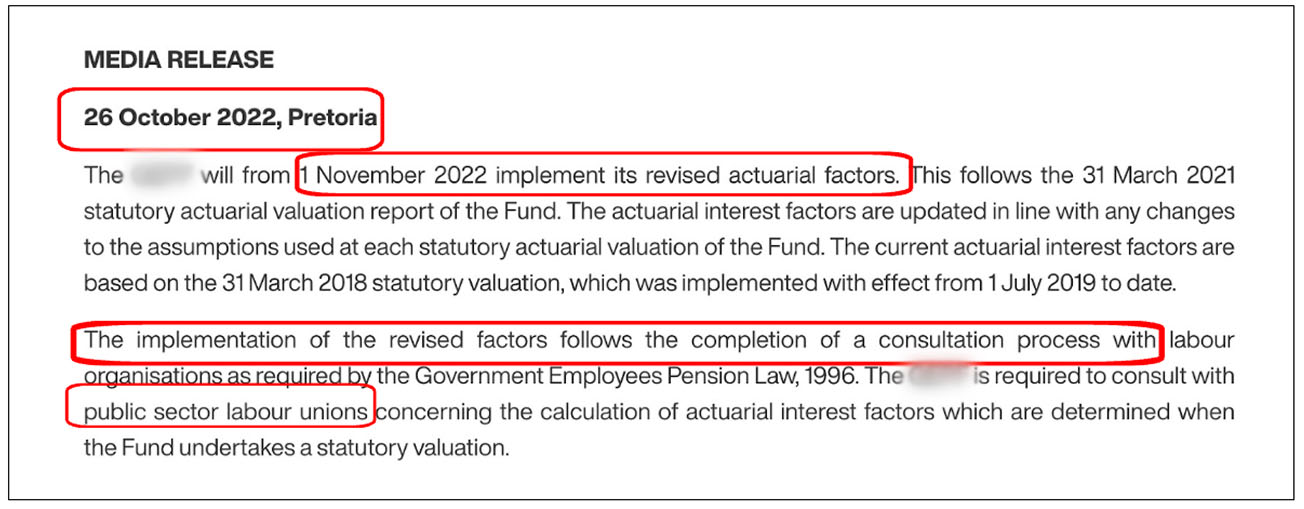

The last change was done on 1st November, 2022. However, the notice was only sent on 26th October, 2022 – just 3 working days before the change took effect.

This short notice meant members were locked in. And the result was devastating. Take a look for yourself:

Loss: R 784,789

This Is Real.

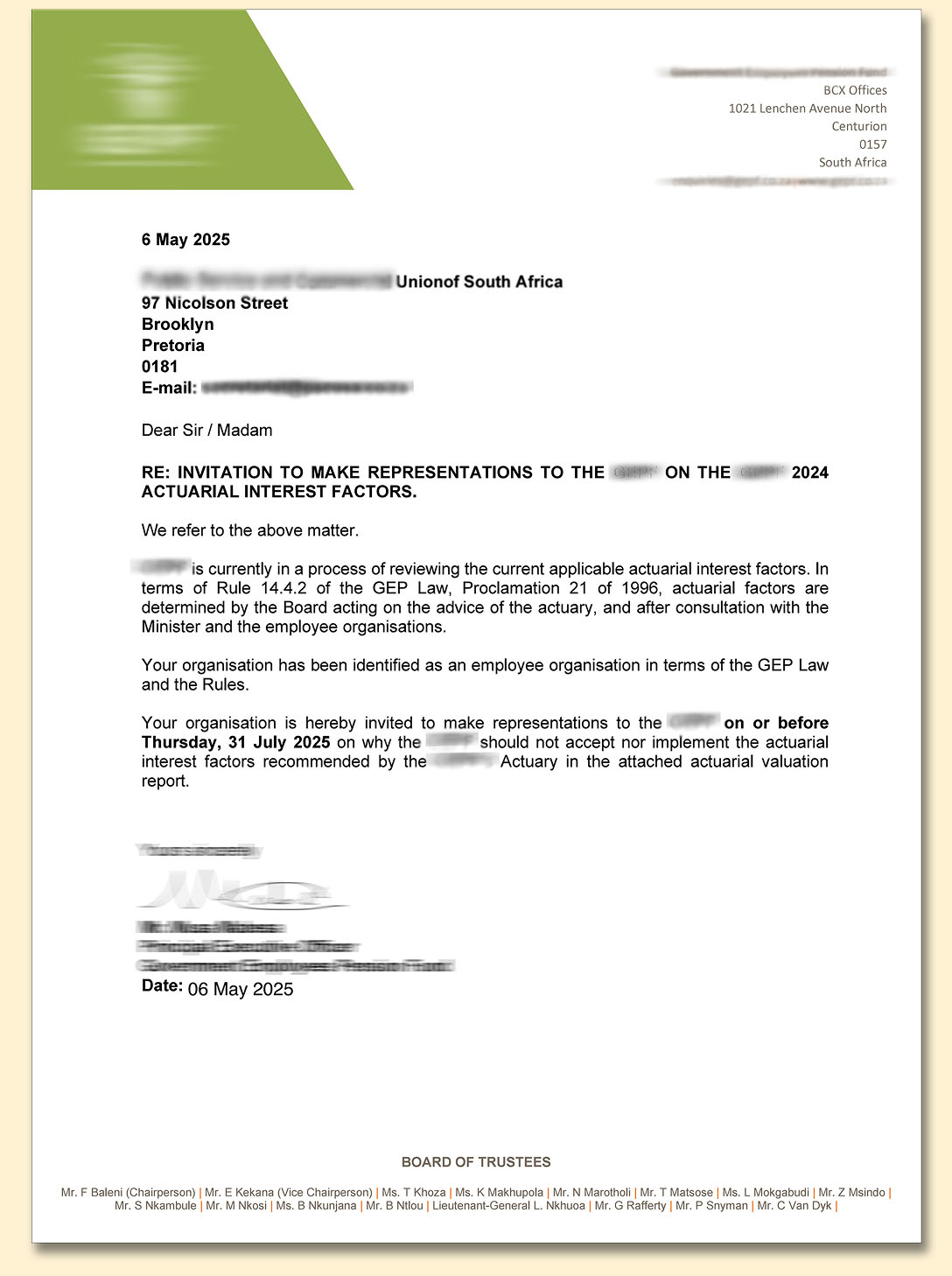

The Unions Have Until 31st July To

Comment on the Formula Change

The pension fund has formally notified the unions that they intend to change the actuarial formula — the very formula that determines how much money you walk away with when you resign.

The unions have been given a clear deadline:

Submit your feedback by 31st July, 2025.

Here’s what that means for you:

The formula change cannot legally happen in August, 2025

But it can happen as early as 1st September, 2025.

And based on previous cycles…That’s exactly how they’ve done it before.

Once the change is made, it’s too late. You won’t get a second chance

Time is running out. You only have:

To protect your money before the next formula change.

That’s why we’ve prepared a special information session for members of:

- SAPS

- Department of Education

- Department of Health

- And all other government employees

What You’ll Learn in This Free Information Session

- If you’re planning to retire or resign within the next 12 months… this session could protect you from losing hundreds of thousands.

Here’s what you’ll walk away with:

-

How to calculate exactly how much you lost in the November, 2022 formula change

(Using real statement comparisons from before and after the change.) -

The shocking truth behind the 3-day notice before the last

formula change

(And why most members never saw it coming) -

How to protect your money before the next formula change hits

(The step-by-step plan you need to act in time.) -

How to compare retirement vs resignation

(before the formula change locks you into the wrong choice) -

The proven tax strategies that have helped government

employees legally save hundreds of thousands

(Why should SARS walk away with your money?)

If You’re Planning to Leave in the Next 12 Months

You’re at the Highest Risk

On 26 October 2022, the pension fund issued this notice to members

It was just 3 working days before they changed the actuarial formula.

On 1st November, 2022, members arrived at work that morning — unaware that their pension values had already been reduced overnight.

Billions were quietly taken away.

Most didn’t even realise what had happened… until it was too late.

People like Basil were caught off guard. He left shortly after the change — and lost over R700,000.

Others had to work another 18 to 24 months just to recover what they lost — just to get back to where they were the day before the change.

After years of service, it all comes down to this:

Leave before the formula changes…

Or work two more years just to catch up.

That doesn’t mean you need to take risks or make costly mistakes.

That’s why this urgent session was created — to help you protect what’s rightfully yours.

Why So Many Government Employees Trust Dhevan With Their Retirement or Resignation Planning

Dhevan Naicker didn’t choose this path—it chose him.

At just 13 years old, he watched his father leave government employment without the right advice. One financial decision cost their family over R500,000. What followed was years of struggle. His dad opened a small tuck shop just to survive. His mother, a full-time housewife, began waking up before sunrise to cook meals to sell.

They worked tirelessly—just to keep the lights on.

Then, in 2023, tragedy struck again. Dhevan received a call that would change his life forever: his mother had passed away suddenly at just 62 years old. The grief was overwhelming—but it left him with one haunting question:

Could things have been different… if only his dad had been given the right information?

That question became his mission.

Today, Dhevan is a Certified Financial Planner™, a cum laude graduate with a Postgraduate Diploma in Financial Planning, and South Africa’s leading specialist for government employees planning to retire or resign.

He made a promise to his late mother that no other government employee should suffer the way his family did.

And he’s kept that promise—helping hundreds of SAPS members avoid costly mistakes, save millions in unnecessary tax, and protect their family’s future.

Dhevan Naicker

Retire vs Resign Specialist for Government Employees

Certified Financial Planner™

Post Graduate Diploma in Financial Planning (cum laude)

Why government employees trust us with their biggest financial decisions

Formula Change Information Session

- Venue: Online via Zoom

- Date: 26th July, 2025

- Time: 9am to 11am

- Cost: FREE

- Eligibility: Government employees only

- Capacity: Limited to 100 members

Your Information

Retirement Wellness SA, F110A, IZULU OFFICE PARK, REY’S PLACE, BALLITO, 4399, South Africa

Authorised Financial Service Provider FSP 31609

Copyright © Retirement Wellness SA

https://retiresa.co.za

The Retire vs Resign Masterclass DOES NOT provide advice in terms of the General Code of Conduct and therefore you are not afforded the same protections in respect of those additional products or services that may apply in respect of the provision of financial products or services in terms of the Act.

Disclaimer: The guidance on ‘Retire or Resign’ decisions provided here is independent and not issued by or on behalf of the Government Employees Pension Fund (GEPF). We do not act on behalf of the GEPF.